Features of Asset Allocation Interactive

Explore beyond mainstream assets and create, save, and blend custom portfolios with expected returns for more than 140 assets and model portfolios. Additional features include:

Empower your investment decisions with our asset allocation platform. Build custom portfolios and expected returns with ease.

Explore and analyze 140+ assets and portfolios in six major currencies: USD, GBP, EUR, JPY, AUD, and CAD.

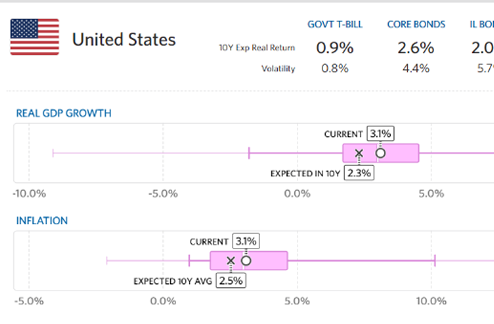

Access and analyze 22 developed markets and 19 emerging markets through the Country View dashboard and throughout the tool.

View expected and historical GDP, equity CAPE, inflation, and more for over forty-one countries across six currencies.

Empower your investment decisions with our asset allocation platform. Build custom portfolios and expected returns with ease.

Download custom portfolio and print high-quality charts to include in presentations.

How Can I Use AAI?

Watch our Research Affiliates experts show you use cases in these highly informative videos:

With the addition of 18 new equity market models, Omid Shakernia demonstrates why diversification is the only free lunch in investing.

Asset diversification does not necessarily imply risk diversification. Brent Leadbetter takes a deeper dive on why both need to be considered when creating a portfolio.

Let Jim Masturzo show you why it’s useful to step back from analyzing specific assets and consider economic conditions so as not to lose the forest for the trees.

“It was the best of times, it was the worst of times,” Charles Dickens wrote in his classic novel, "A Tale of Two Cities". Victor Miller discusses how this phrase best describes the state of equity markets for the past decade and the expectations for the next decade given today’s valuations.

Frequently Asked Questions

Asset Allocation Interactive (AAI) provides estimates of long-term expected returns for more than 140 assets and model portfolios across six currencies: US Dollar, European Euro, British Pound, Japanese Yen, Australian Dollar, and Canadian Dollar.

AAI offers the ability to create, save and blend customized portfolios, and features two expected return models—valuation dependent, and yield & growth.

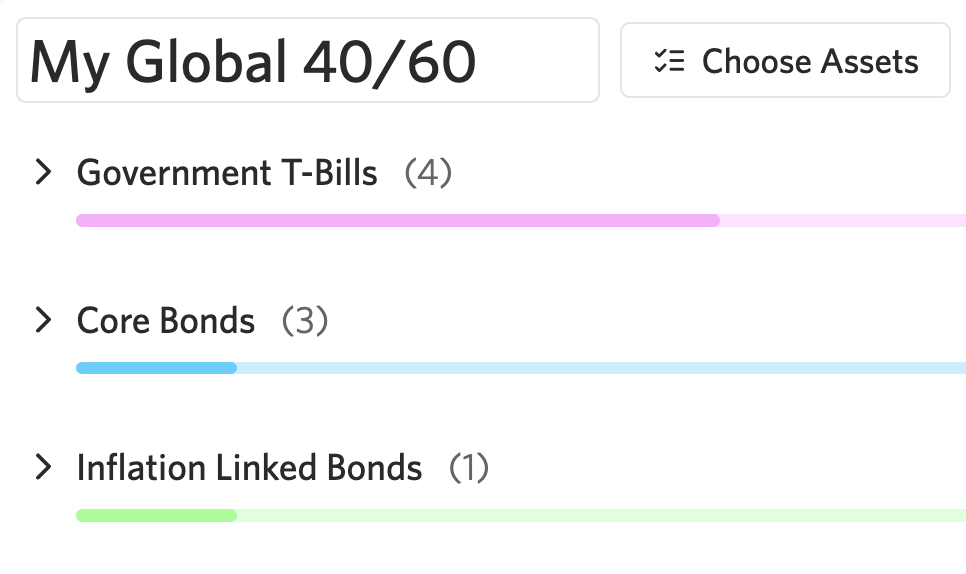

To create a custom portfolio in AAI, click the "+ Create a New Portfolio" text link at the bottom of the Portfolios pane in the upper left-hand list. You'll notice the interface switches to the Portfolio and Analysis mode.

In the Portfolio Builder section, you can customize the name of your portfolio and begin choosing assets.

By default, the portfolio will be 100% allocated to Uninvested Cash in the currency of the portfolio. Allocate percentages of that cash to your assets using the weight fields provided.

To finish, click on the Save button at the lower-right hand of the pane. Your new portfolio will appear in the left-hand pane under 'My Portfolios,' as well as on the scatter plot.

AAI offers two options for models when calculating expected returns: (1) Valuation Dependent, and (2) Yield & Growth. The default model is Valuation Dependent.

To change, click on 'Expected Returns Model' at the top of the App.

From here, you have the option to select either of the two models or create a custom blend by clicking '+ Create New' and inputting the blended weights for each.

The underlying data for AAI is updated monthly.

Yes. At any point while navigating AAI, users can print the chart(s) they are viewing by clicking the "Print" icon at the bottom right to prompt the print dialog. From there, users can change settings and select or deselect options from the right side of the screen before clicking the final print button.

AAI has more than 20 other charts and views to select from. All the options available are displayed on the Views tab in the right pane of the app. Select your view and use the left pane list of Portfolios, Assets, and/or Countries to navigate and dive deeper.

Yes, an excel download is available in the tool. Please note that time-series data is not available in the file.

* Asset Allocation Interactive from 01/01/2018 - 02/29/2024 had 4.3 million interactions.

JIM MASTURZO

CIO Multi-Asset Strategies

“Strategic portfolio positioning should start from the perspective of where assets are priced today, not what they returned in the past. AAI provides investors with these conditional expectations, along with transparency regarding the methodology and building blocks driving the expectations."